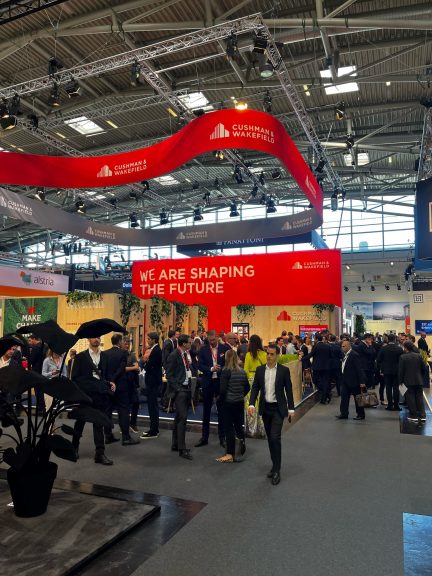

From technologies to the beer: A week of work and fun with our international team

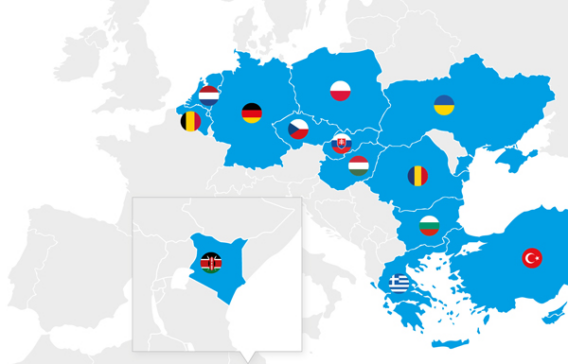

This week we had a visit from our international colleagues from Germany, Poland, Slovakia, Bulgaria and Romania. Together we visited some of our major clients’…

28.03.2024

Read more

28.03.2024

Read more

800 111 112

More information

800 111 112

More information